Questions?

Contact us at support line.

US: 877-270-3475

or

Log in to back office to chat with a representative

Contact us at support line.

US: 877-270-3475

or

Log in to back office to chat with a representative

Visit NCR.com/Silver

Browse by categories

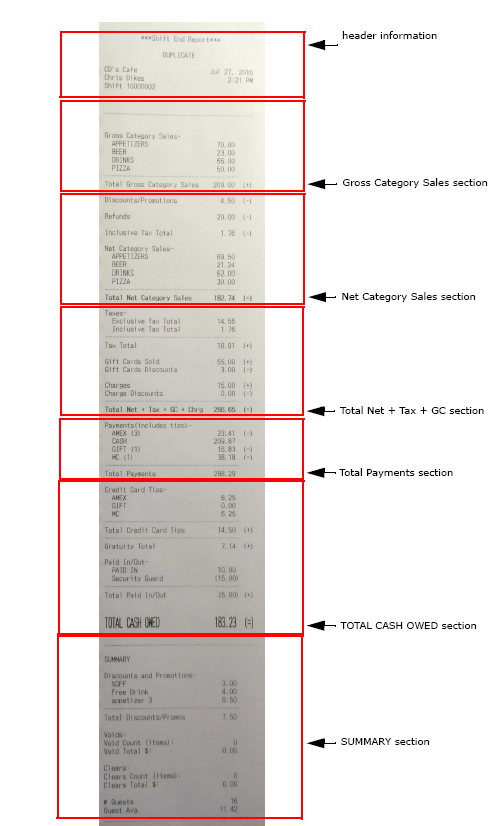

The Shift End report determines the amount of money owed by or to an employee at the end of a financial shift. The Shift End Report includes an accounting of all sales activity of the employee, including sales, discounts, taxes, gift cards sold, payments, petty cash transactions, voids, and credit card tips.

| Report Section | Description |

|---|---|

| Header |

Header includes:

|

|

Gross Category Sales

|

Gross Category Sales includes:

|

|

Net Category Sales

|

Net Category Sales includes:

|

|

Total Net + Tax + GC + Chrg

|

Total Net + Tax + GC + Chrg includes:

|

|

Total Payments

|

Total Payments calculates:

|

|

TOTAL CASH OWED

|

TOTAL CASH OWED includes:

If your employees keep credit card tips in the form of cash at the end of their shift, the system calculates TOTAL CASH OWED as: Gross Sales - Discounts - Refunds - Inclusive Taxes + Tax Total + Gift Cards Sold + Charges - Gift Cards Discounts - Charges Discounts - Credit Card Tender Types (including tip amounts) - Gift Cards Redeemed - Paid Outs + Paid Ins.

If your employees do not keep credit card tips in the form of cash at the end of their shift, the system calculates TOTAL CASH OWED as: Gross Sales - Discounts - Refunds - Inclusive Taxes + Tax Total + Gift Cards Sold + Charges - Gift Cards Discounts - Charges Discounts -Credit Card Tender Types (including tips) - Gift Cards Redeemed - Paid Outs + Paid Ins + Electronic Tips + Gratuity. |

|

SUMMARY

|

SUMMARY includes:

|