Questions?

Contact us at support line.

US: 877-270-3475

or

Log in to back office to chat with a representative

Contact us at support line.

US: 877-270-3475

or

Log in to back office to chat with a representative

Visit NCR.com/Silver

Browse by categories

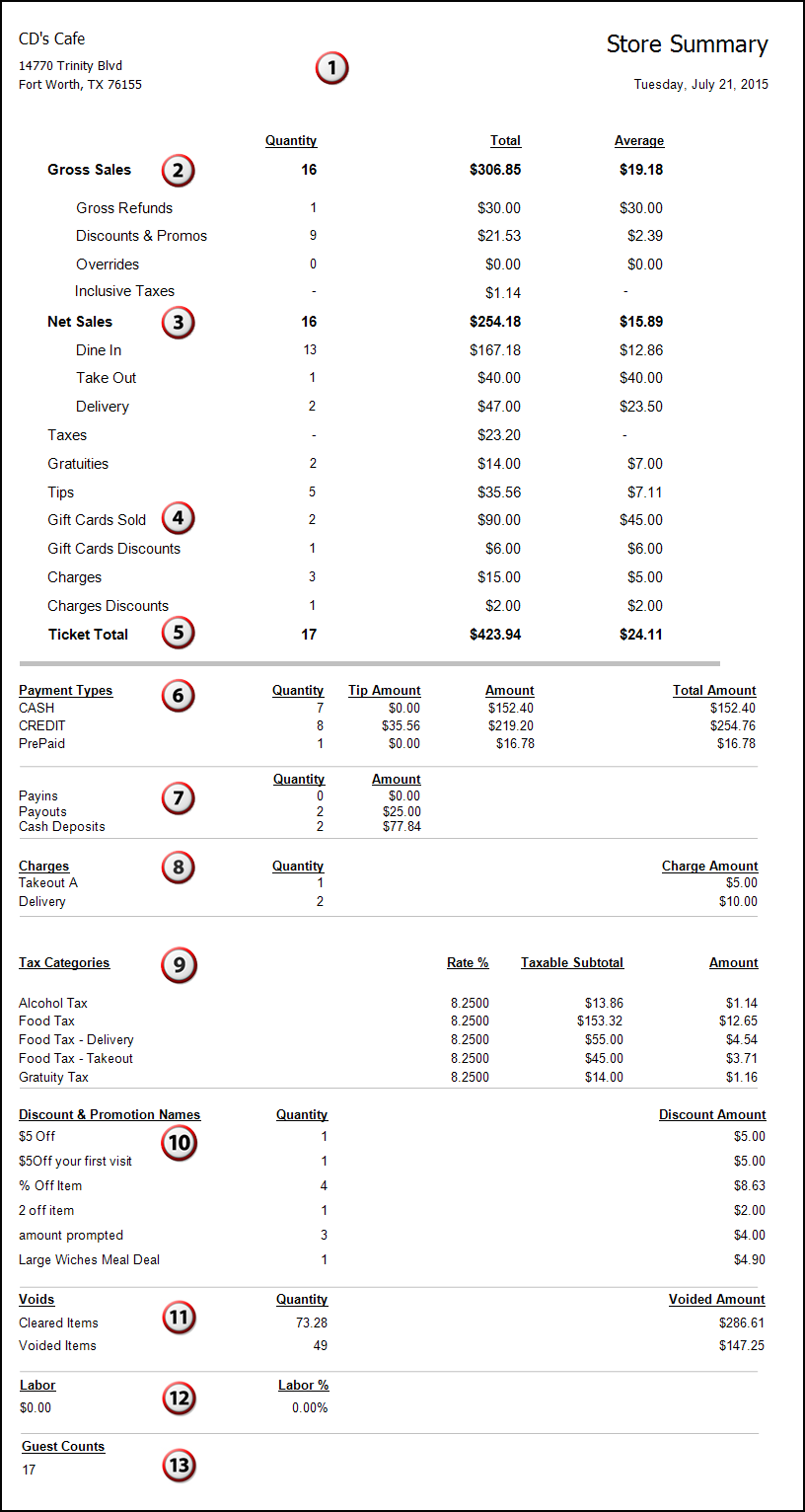

The Store Summary report enables you to review a summary of your sales activity for a selected time period. You can view such things as gross sales, net sales, payment types, discounts, price overrides, and more. If you operate multiple locations, the Store Summary report defaults to all locations; however, you can filter the report to display only the results of one location.

- On the Reports menu, select Store Summary. The system generates a report for all locations for today.

- For restaurants with multiple locations, click

to select a location from the drop-down list.

- Click

in the Report Preview toolbar to refresh the data. The report appears in the Report Preview screen.

| # | Column | Description |

|---|---|---|

| 1 | Header | Header includes:

|

| 2 | Gross Sales | Gross Sales calculates your total number of sales tickets and your total amount of sales before gross refunds, discounts, overrides, and inclusive taxes. For each line item in the Gross Sales Section, the system summarizes as follows:

|

| 3 | Net Sales | Net Sales calculates your total number of sales tickets and your sales amount after subtracting gross refunds, discounts, overrides, and inclusive taxes. For each order mode, the system summarizes the total number of tickets, the total amount of net sales, and the average dollar amount per ticket. You can see a breakdown of sales by order type under the Net Sales. |

| 4 | Miscellaneous Items | Miscellaneous items includes:

|

| 5 | Ticket Total | Ticket Total summarizes:

|

| 6 | Payment Types | Payment Types summarizes payments received by tender, and includes:

|

| 7 | Cash Transactions | Cash Transactions summarizes your cash transactions by transaction type, and includes:

|

| 8 | Charges | Charges summarizes the charges assessed. The summary includes:

|

| 9 | Tax Categories | Tax Categories summarizes the collected sales taxes according to category, and includes:

|

| 10 | Discount & Promotion Names | Discount Names summarizes the discounts and promotions redeemed by discount and promotion, and includes:

|

| 11 | Voids | Voids summarizes the items deleted, and includes:

|

| 12 | Labor | Labor summarizes the cost of labor, and includes:

|

| 13 | Guest Counts | (Table Service only) The total number of guest counts, calculated as the total number of seats on a ticket. |